Zamri Bin Mustaffa@Dollah JG 5724/11

Nor Ardillah Binti Osman JG 5423/11

Nurazlin Binti Waishak JG5507/11

Nor Hafizah Binti Ab Samad JG 5436 /11

Mahizatuakema Binti Zakaria JG 5265 /11

Tuesday, January 28, 2014

Friday, January 24, 2014

INTERNATIONAL INVESTMENT THEORIES.

Why does FDI occur? A sophomore taking his or her

first finance course might answer with the obvious: Average rates of return are

higher in foreign markets. Yet given the pattern of FDI between countries that

we just discussed, this answer is not satisfactory, and Canada and the United

Kingdom are both major sources of FDI in the United States and important

destinations for FDI from the United States. Average rates of return in Canada

and the United Kingdom cannot be simultaneously below that of the United States

(which would justify inward U.S.FDI) and above that of the United States (which

would justify outward U.S.FDI).The same pattern of two-way investment occurs on

an industry basic. By the end of 2007, for example, U.S firm had invested $8.0

billion in the chemical industry in the Netherland.While Dutch Firm had

invested $44.7 billion in the U.S chemical industry. This pattern cannot be

explained by national or industry differences in rates of return .We must

search for another explanation for FDI.

Ownership Advantages.

More powerful explanation for FDI focus on the role

of the firm. Initially researcher explored how firm ownership of competitive

advantages affected FDI .The ownership advantage theory suggests that a firm

owning a valuable asset that creates a competitive advantage domestically can

use advantage to penetrate foreign markets though FDI. The asset could be, for

example, a superior technology, a well-knows brand name, or economies of scale.

This theory is consistent with the observed patterns of international and

industry FDI discussed earlier in this chapter. Caterpillar, for example, built

factories in Asia, Europe, Australia, South America, and North America to

exploit proprietary technologies and its brand name .Its chief rival, Komatsu,

constructed plants in Asia, Europe, and the United States for the same reason.

Internalization

Theory.

The ownership advantage theory only partly explains

why FDI occur. It does not explains why a firm would choose to enter a foreign

market via FDI rather exploit For

example, McDonald’s has successfully internationalized by franchising its

fast-food operations outside the United States, while Boeing has relied on

exporting to serve foreign customers.

Internalization theory addresses this question. In

doing so, it relies heavily on the concept of transaction costs. Transaction costs are the costs of

entering into a transaction, that is, those connected to negotiating,

monitoring, and enforcing a contract. A firm must decide whether it is better

to own and operate its own factory overseas or to contract with a foreign firm

to do this through a franchise, licensing, or supply agreement. Internalization theory suggests that

FDI is more likely to occur-that is, international production will be

internalized within the firm-when the costs of negotiating, monitoring, and enforcing

a contract with a second firm is high. For example, Toyota ‘primary competitive

advantages are its reputation for high quality and its sophisticated

manufacturing techniques, neither of which is easily conveyed by contract. As a

result, Toyota has chosen to maintain ownership of its overseas automobile

assembly plants.

Conversely, internalization theory holds that when

transaction coast are low, firms are more likely to contract with outsider and

internationalize by licensing their brands names or franchising their business

operation. For example, McDonald’s is the premier expert in the United States

in devising easily enforceable franchising agreements. Because McDonald’s is so

successful in reducing transaction costs between itself and its franchisees, it

is continued to rely franchising for its international operations.

Dunning’s Eclectic Theory

Although internalization theory addresses why firms

choose FDI as the mode for entering international markets, the theory ignores

the question of why production by either the company or a contractor, should be

located abroad. In other words, is there a location advantage to producing

abroad? This issue was incorporated by John Dunning in his eclectic theory, which combines ownership advantage, location advantage,

and internalization advantage to form a unified theory of FDI. This theory

recognizes that FDI reflects both international business activity internal to

the firm. According to Dunning, FDI will occur when three conditions are

satisfied.

1. Ownerships

advantage. The firm must own some unique competitive advantage that overcomes

the disadvantage of competing with foreign firm in their home turfs. This

advantage may be a brand name, ownership of proprietary technology, the

benefits of economies of scale, and so on. Caterpillar, for example, enjoys all

three of these advantages in competing in Brazil against local firms.

2. Location

advantage. Undertaking the business activity must be more profitable in a

foreign location than undertaking it in a domestic location. For example,

Caterpillar produces bulldozer in Brazil enjoy lower labor costs and avoid high

tariff walls on good exported from its U.S. factories.

3. Internalization

advantage .The firm must benefit more from controlling the foreign business

activity than from hiring an independent local company to provide the service.

Control is advantageous, for example, when monitoring and enforcing the

contractual performance of the local company may misappropriate proprietary

technology, or when the firm’s reputation and brand name could be jeopardized

by poor behavior by the local company. All of these factors are important to Caterpillar.

Factors Influencing

Foreign Direct Investment.

Given the complexity of

the global economy and the diversity of opportunities that firms face in

different countries, it is not surprising that numerous factors may influence a

firm’s decision to undertake FDI. These can be as supply factors, demand

factors, and political factors (see table 6.5)

TABLE 6.5 Factors

Affecting the FDI Decisions

Supply

Factors Demand

factors Political

factors

Production costs Customer access Avoidance of trade

barriers

Logistics Marketing

advantages Economic

development Resource availability Exploitation of competitive incentives

Advantage

Access

to technology customer

mobility

Supply

Factors.

A

firm’s decision to undertake FDI may be influenced by supply factors, including

production costs, logistic, availability of natural resources, and access to

key technology.

PRODUCTION

COSTS. Firms often undertake may be more

attractive than domestic sites because of lower land prices, tax rates,

commercial real estate rents, or because of better availability and lower costs

of skilled or unskilled labor. For example, Intel built a new chip fabrication

facility in Chengdu in China’s remote Sichuan province because labor and land

costs were must lower than Shanghai, where the company already operates three

facilities. Similarly, Samsung will build a $670 million mobile phone assembly

plant in northern Vietnam to take advantage of the area’s low labor costs.

LOGISTICS.

If transportation costs are significant, a firm may choose to produce in the

foreign market rather than export from domestic factories. For example,

Heineken has utilized FDI extensively as part of its internationalization

strategy because its products are primarily water. Brewing its beverages close

to where its foreign consumers live is cheaper for Heineken than transporting

the beverages long distances from the company’s Dutch breweries. International

businesses also often make host-country investments to reduce distribution

costs. For example, Citrovita, a Brazilian producer of orange juice

concentrate, operates a storage and distribution terminal at the Port of

Antwerp rather than ship to European grocery chains directly from Brazil.

Citrovita can take advantage of low ocean-shipping rates to transport its good

in bulk from Brazil to the Belgian port. The company then uses the Antwerp

facility to repackage and distribute concentrate to its customer in France,

Germany, and the Benelux countries.

AVAILABILITY

OF NATURAL RESOURCES. Firms may utilize FDI to access natural resources that

are critical to their operation. For instance, because of the decrease in oil

production in the United States, many U.S.-based oil companies have been force

to make signification investment worldwide to obtain new oil reserves. Often

international businesses negotiate with host government to obtain access to raw

materials in return for FDI. For example, in 2007 the china National Petroleum Company

created a joint venture with state-owned

Petroleos de Venezuela that will invest

$10 billion to extract, refine, and transport 1

million barrels of oil a day Venezuela’s Orinoco basin (see Map 6.1)

ACCESS

TO KEY TECHNOLOGY. Another motive for FDI is to gain access to technology.

Firms may find it more advantageous to acquire

ownership interests in an existing firm than to assemble an in-house

group of research scientists to develop or reproduce an emerging technology.

For instance, many Swiss pharmaceutical manufacturers have invested in small

U.S. biogenetics companies as an inexpensive means of obtaining cutting –edge

biotechnology. Similarly, in 2007 Korea‘s Doosan Infracore paid $4.9 billion

for the Bobcat division of Ingersoll-Rand, in order to benefit from Bobcat’s

superior technology, outstanding network, and skilled management team. Taiwan‘s

Acer Inc., manufacturer of personal computers and workstations, paid $100

million in the 1990s for a pair of silicon Valley computer companies in the

hope of leveraging their technology and existing distribution network to boost

Acer’s share of the U.S. personal computer market.

Demand

factors.

Firm

also may engage in FDI to expand the market their products. The demand factors

that encourage FDI include customer access marketing advantage, exploitation of

competitive advantages, and customer mobility.

CUSTOMER

ACCESS. Many types of international business require firms to have a physical

presence in the market. For example, fast-food restaurants and retailers must

provide convenient access to their outlets for competitive reasons.KFC cannot

provide freshly prepared fried chicken to Japanese customers its restaurants in

the United States; it must locate outlets in Japan to do so . Similarly, IKEA‘s

success in broadening its customer base beyond its home market in Sweden is due

to its opening a number of new stores worldwide.

MARKETING

ADVANTAGES. FDI may generate several

types of marketing advantages. The physical presence of a factory may enhance

the visibility of a foreign firm’s products in the host market. The foreign

firm also gains from “buy local” attitudes of host country consumers. For

example, through ads in such many magazines as Time and sports illustrated,

Toyota has publicized the beneficial impact of its U.S. factories and input

purchases on the U.S. economy. Firms may also engage in

FDI to improve their customer service. Taiwan’s Delta products, which makes

battery packs for laptop computers, was concerned that it could not respond

quickly and flexibly enough from its factories in china and Thailand to meet

the changing needs of its U.S. customers. As one of executives noted, if you

“build in the Far East, you’re too far away. You can’t do last-moment

modification while the product is on the ocean.” Accordingly, Delta shifted

some of its production to a Mexican factory just across the border from

Nogales, Arizona, to better serve its U.S. customers.

CUSTOMER

MOBILITY. A firm’s FDI also may be motivated by the FDI of its customers or

clients. If one of a firm existing customer builds a foreign factory, the firm

may decide to locate a new facility of its own nearby, thus enabling it to

continue to supply its customers promptly and attentively. Equally important,

establishing a new reduces the possibility that a competitor in the host

country will step in and steal the customer. For example, Japanese parts

suppliers to the major Japanese automakers have responded to the construction

of Japanese owned automobile assembly plants in the United States by building

their own U.S. factories, warehouses, and research facilities. Their need to

locate facilities in the United States is magnified by the automakers’ use

Just- In –Time (JIT) inventory management techniques; IT minimizes the amount

of part s inventory held at an assembly plants, putting a parts-supply facility

located in Japan at a severe disadvantage. Likewise, after Samsung decided to

construct and operate an electronics factory in northeast England, six of its

Korean parts suppliers also established factories in the Vicinity.

Political

factors.

Political

factors may also enter into a firm’s decision to undertake FDI .Firms may invest

in a foreign country to avoid trade barriers by the host country or take

advantage of economic development incentives offered by the host government.

AVAOIDANCE

OF TRADE BARRIERS. Firms often build foreign facilities to avoid trade

barriers, For example, the Fuji Photo Film company invested $200 million its is

Greenwood, south Carolina ,factory complex to begin manufacturing film for sale

in the united states. Previously, the company supplied film its U.S. customers

from its exporting to it, Fuji avoided a 3.7 percent tariff on film imposed by

the United States and deflected claims by Kodak that Fuji was unfairly

“dumping” Japanese-made in the U.S. market( dumping is explained in chapter

9).Other types of government policies may also impact FDI. Microsoft, for

example, is locating a software development center in Richmond, British

Colombia, in part to avoid limitations placed by the U.S. government on the

number of highly skilled immigrant

workers who can obtain H-1B works visas

in any given year.

ECONOMIC

DEVELOPMENT INCENTIVES. Most democratically elected governments-local, states,

and national-are vitally concerned with promoting the economic welfare of their

citizens, many of whom are, of course, voters. Many government offer incentives

to firms to induce them to locate new facilities in the governments’

jurisdictions. Governmental incentives

that can be an important catalyst for FDI include reduced utility rates,

employee training programs, and infrastructure additions (such as new roads and

railroad spurs),and tax reduction or tax

holidays. Often MNCs benefit from bidding wars among communities eager to

attract the companies and the jobs they bring. For instance, Georgia agreed to

provide Kia Motors $400 million in incentives to capture that firm’s first U.S. plant, which is expected to employ

2.500 workers once it becomes operational. Likewise, in 2006, Samsung

Electronics announced it would locate its latest chip factory in Austin, after

the city and the state granted it a $233 million incentive package.

Type of international investment

International

investment as discussed in chapter 1 is divided into two categories: foreign

portfolio investment (FPI) and foreign direct investment (FDI).The distinction

between the two rests on the question of control: Does the investor seek an

active management role in the firm of merely a return from a passive

investment?

a. Sources of FDI in United States

United Kingdom 410.8

Japan 233.1

Canada 213.2

Netherlands 209.4

Germany 202.6

France 168.6

Switzerland 155.7

Luxembourg 134.3

Australia 49.1

Bermuda,The Bahamas, and other Caribbean island 38.7

Other European countries 75.9

Total 2092.9

b. Destination of FDI from the United States

United Kingdom 398.8

Nertherlands 370.2

Canada 257.1

Bermuda,The Bahamas, and other Caribbean islands 243.3

Switzerland 127.7

Luxembourg 113.6

Germany 107.9

Japan 101.6

Mexico 91.7

Ireland 87.0

Other European countries 364.5

All other countries 546.5

Total 2791.9

Source : Suvey of Current Business , July 2008,pp.33,35.

Foreign portfolio investment

represent passive holding of securities such as foreign stocks bonds ,or other

financial assets , none of which entails active management or control of the

securities” issuer by the investor .Modern finance theory suggests that foreign

portfolio investments will be motivated by attempts to seek an attractive rate

of return as well as the risk reduction that can come from geographically

diversifying one’s investment portfolio .Sophisticated money managers in new

York ,London, Frankfurt, Tokyo and other financial centers are well aware of

the advantages of international design securities ,bring their total holdings of such securities to

$6.6 trillion. Foreign official and private investors purchased $$890 billion

worth of us. corporate, federal state, and local securities, raising their

total holding of such securities to $8.6 trillion.

Foreign direct investment (FDI) is

acquisition of foreign asset for the purpose of controlling for them .U.S. government

statisticians define FDI as” ownership or control of 10 percent or more of an

enterprise” voting securities or the equivalent interest in an unincorporated

business”. FDI may take many forms, including purchase of existing assets in a

foreign country, new investment of property, plant, and equipment, and

participation in a joint venture with a local partner. Perhaps the most

historically significant FDI in the United States was the $24 that Dutch

explore Peter Minuet paid local Native Americans Manhattan Island. The result:

New York City, one of the world’s leading financial and commercial centrals.

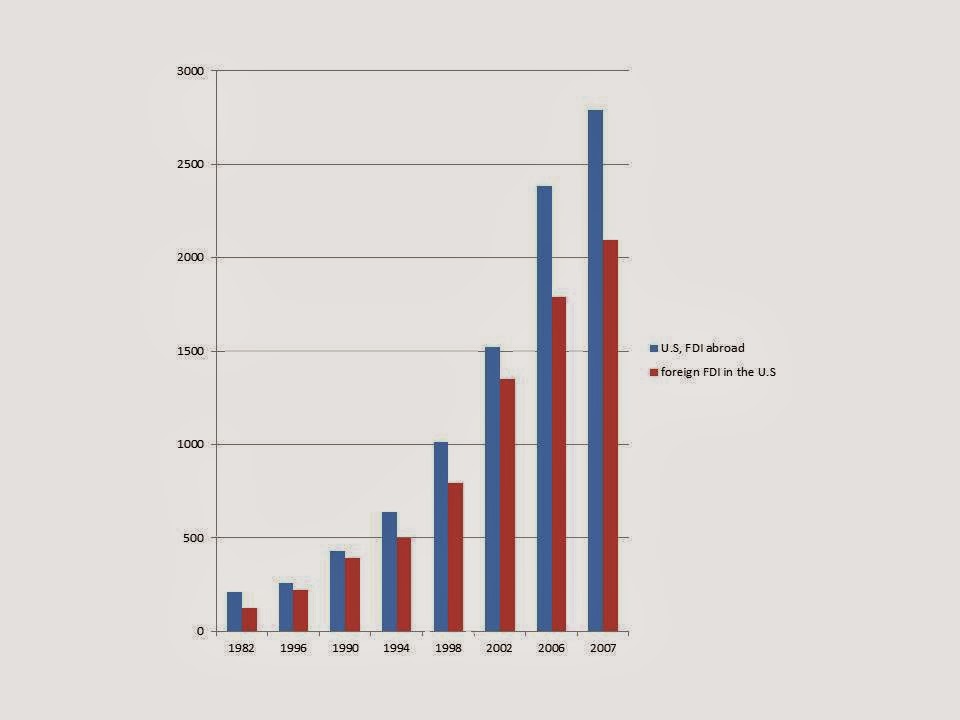

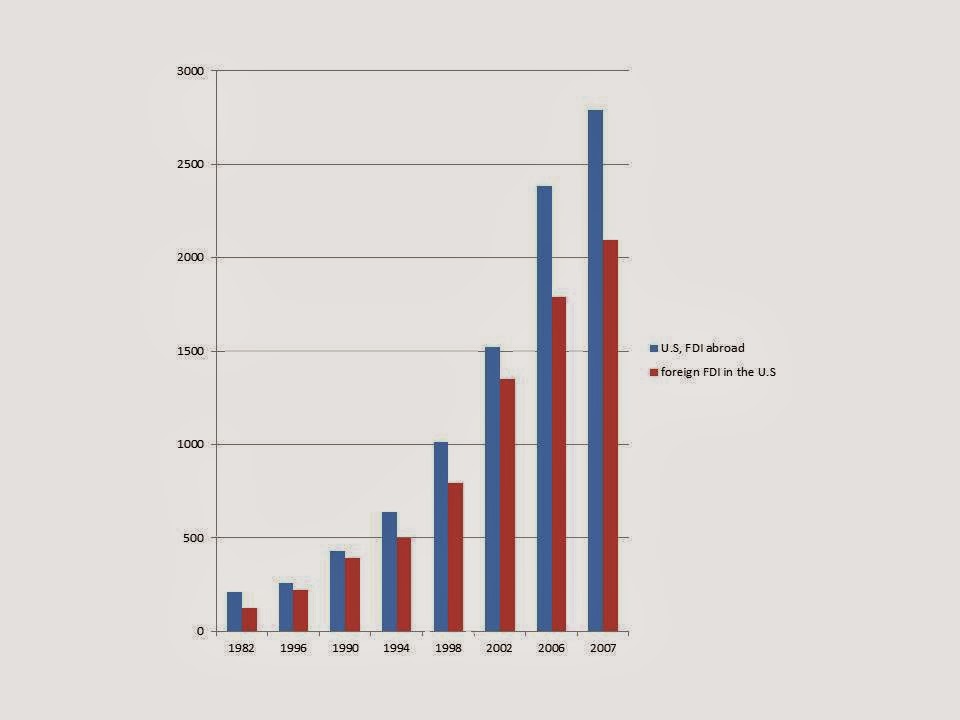

Figure 6.7

Stock of Foreign Direct Investment,

by Recipient (in billions of dollars)

The

Growth of foreign Direct Investment.

The growth of foreign direct investment during the

past 30 years has been er phenomenal .As figure 6.7 indicates, in 1967the total

stock (or cumulative value) of FDI received by countries worldwide was slightly

over $100 billion. Worldwide FDI as of 2006 topped $12.5 trillion. This

stunning growth in FDI –and its acceleration in the 1990s-reflects the

globalization of the world’s economy. As you might expect, most FDI comes from

developed Countries. Surprisingly, most FDI also goes to deleted countries .We

discuss later in the chapter reason for this explosive growth in FDI.

Foreign

Direct Investment and the United States.

We can gain additional insights into FDI by looking

at individual countries .Consider the stock of FDI in the united states, which

totaled $2.1 trillion (measured at historical cost) at the end of 2007( see

table 6.4[a]).The United Kingdom was the most important source of this FDI

,accounting for $410.80 billion ,or 20 percent of total. The countries listed

by name in table 6.4( a) account for 87percent of total FDI in the United

States.

The stock

of FDI U.S residents in foreign countries totaled $ 2.8 trillion at the end of

2007(see table 6.4[b]).Most of this FDI was in other developed countries,

particularly the united kingdom ($398.8 billion) and the Netherland ($370.2

billion).The countries listed by name in table 6.4 (b) account for 68 percent

of total FDI from the united states.

Looking at

table 6.4, you may wonder why Bermuda, the Bahamas and other small Caribbean

island are so important. The serve as offshore financial centers, which we will

discuss in chapter 8.Many U.S companies set up finance subsidiaries in such

centers to take advantage of low taxes and business-friendly regulations

similarly, many financial services companies from other countries establish

such subsidiaries as the legal owner of their U.S operation.

During the past decade outward FDI has

remained larger than inward FDI for the United States (see figure 6.8), but

both categories have tripled in size. Although inward and outward flows of FDI

are not perfectly matched, the pattern is clear: Most FDI is made by and

destined for the most prosperous countries. In the next section we discuss how

this pattern suggests the crucial role MNCs play in FDI.

a. Sources of FDI in United States

United Kingdom 410.8

Japan 233.1

Canada 213.2

Netherlands 209.4

Germany 202.6

France 168.6

Switzerland 155.7

Luxembourg 134.3

Australia 49.1

Bermuda,The Bahamas, and other Caribbean island 38.7

Other European countries 75.9

Total 2092.9

b. Destination of FDI from the United States

United Kingdom 398.8

Nertherlands 370.2

Canada 257.1

Bermuda,The Bahamas, and other Caribbean islands 243.3

Switzerland 127.7

Luxembourg 113.6

Germany 107.9

Japan 101.6

Mexico 91.7

Ireland 87.0

Other European countries 364.5

All other countries 546.5

Total 2791.9

Source : Suvey of Current Business , July 2008,pp.33,35.

Type of international investment.

International

investment as discussed in chapter 1 is divided into two categories: foreign

portfolio investment (FPI) and foreign direct investment (FDI).The distinction

between the two rests on the question of control: Does the investor seek an

active management role in the firm of merely a return from a passive

investment?

Foreign portfolio investment

represent passive holding of securities such as foreign stocks bonds ,or other

financial assets , none of which entails active management or control of the

securities” issuer by the investor .Modern finance theory suggests that foreign

portfolio investments will be motivated by attempts to seek an attractive rate

of return as well as the risk reduction that can come from geographically

diversifying one’s investment portfolio .Sophisticated money managers in new

York ,London, Frankfurt, Tokyo and other financial centers are well aware of

the advantages of international design securities ,bring their total holdings of such securities to

$6.6 trillion. Foreign official and private investors purchased $$890 billion

worth of us. corporate, federal state, and local securities, raising their

total holding of such securities to $8.6 trillion.

Foreign direct investment (FDI) is

acquisition of foreign asset for the purpose of controlling for them .U.S. government

statisticians define FDI as” ownership or control of 10 percent or more of an

enterprise” voting securities or the equivalent interest in an unincorporated

business”. FDI may take many forms, including purchase of existing assets in a

foreign country, new investment of property, plant, and equipment, and

participation in a joint venture with a local partner. Perhaps the most

historically significant FDI in the United States was the $24 that Dutch

explore Peter Minuet paid local Native Americans Manhattan Island. The result:

New York City, one of the world’s leading financial and commercial centrals.

Global Strategic Rivalry Theory

More

recent explanations of the pattern of international trade. Develop in the 1980s by such

economists as Paul Krugman and Kevin Lancaster examine the impact on the trade

flows of global strategic rivalry between MNC’S. According to this view, firms

struggle to develop some sustainable competitive advantage, which they can then

exploit to dominate the global marketplace. Like Linder’s approach, global strategic

rivalry theory predicts that intraindustry trade will be commonplace. It

focuses, however, on strategic decisions that firms adopt as they compete

internationally. These decisions affect

both international trade and international investment. Companies such as

Caterpillar and Komatsu, Unilever and Protect & Gamble, and Toyota and Ford

continually play cat-mouse games with one another on a global basis as they

attempt to leverage their own strengths and neutralize those of their rivals.

Firms

competing in the global marketplace have numerous ways of obtaining a

sustainable competitive advantage. The more popular ones are owning

intellectual property rights, investing in research and development (R&D),

achieving economies of scale or scope, and exploiting the experience curve. We

discuss each of these options next.

OWNING

INTELLECTUAL PROPERTY RIGHTS. A firm

that owns an intellectual property rights- a trademark, brand name, patent, or

copyright-often gains advantages over its competitors. For instance, owning

prestigious brand names enables Ireland’s Waterford Wedgwood Company and

France’s LVMH Moet Hennessy Louis Vuitton to charge premium prices for their

upscale products. And Coca- Cola and PepsiCo compete for customers worldwide on

the basis of their trademark and brand names.

INVESTING

IN RESEARCH AND DEVELOPMENT. R&D is

a major component of total cost of high-technology products. For example,

Airbus has spent over $12 billion developing its new superjumbo jet, the A380.

Firms in the computer, pharmaceutical and semiconductor industries also spend

large amounts on R&D to maintain their competitiveness. Because of such

large ‘entry’ costs, other firms often hesitate to compete against established

firms. Thus the firms that acts first often gains a first-mover advantage.

However,

knowledge does not have nationality. Firms that invest up front and secure the

first-mover advantage have the opportunity to dominate the world market for

goods that are intensive in R&D . According to the global strategic rivalry

theory, trade flows may be determined by which firms make the necessary R&D

expenditures. Why is the European Union a large exporter of commercial

aircrafts? Because Airbus is one of the few firms willing to spend the large

sums of money required to develop new aircrafts and because it just happens to

be headquatered in new technology to maintain their leadership in the world

flower markets.

Firms

with large domestic markets may have an advantage over their foreign rivals in

high –technology markets because these firms often are able to obtain quicker

and richer feedback from customer. With this feedback the firms can fine-tune

their R&D efforts enabling the firms to better meet the needs of their

domestic customers. This knowledge can be utilized to serve foreign customers.

For example, U.S agricultural chemical producers such as Monsanto and Eli

Llilly have advantage over Japanese rivals in developing soybean pesticide

because the U.S markets for such pesticide is large while the Japanese market

is small. Knowledge gained in the U.S pesticide market can be readily

transferred to meet the needs of Japanese farmers.

ACHIEVING

ECONOMIES OF SCALE OR SCOPE. Economies of scale or scope offers firms another

opportunity to obtain a sustainable competitive advantage in international

markets. Economies of scale occur when a products average costs decrease as the

number of units produced increases. Economies of scope occur when a firms

average costs decreased as the number of different products it sells increase.

Firms that are able to achieve economies of scale or scope enjoy low average

costs, which give the firms a competitive advantage over their global rivals.

Both of these economies are particulary important for e-retailers. Amazon.com,

for example, has spent enormous sums developing and maintaining its Website and

building its customer base. Because many of these costs are fixed, the company

average costs per sale decline as the company expands its sales. In its quest to

capture the volume-driven economies of scale, Amazon.com has been expanding its

operations into the international marketplace. Moreover, the marginal cost of

adding an additional product line to its Web site is relatively small.

Accordingly, the company has expanded from books to compact disc to DVDS to

sporting goods to capture such economies of scope.

EXPLOITING

THE EXPERIENCE CURVE. Another source of

firm-specific advantages in international trade is exploitation of the

experience curve. For certain types of products production cots decline as the

firm gains more experience in manufacturing the product. Experience curves may be so significant that

they govern global competition within industry. For instance, in semiconductor

chip production, unit cost reduction of 25 to 30 percent with each doubling of

a firms cumulative chip production are not uncommon. Any firm attempting to be

low-cost producer of so-called commodity chips- such as 512MB memory chips-can

achieve that goal only if it moves further along the experience curve that its

rivals do. Both U.S and Asian chip manufacturers have often priced their new

products below current production costs to capture the sales necessary to

generate the production experience that will in turn enable the manufactures to

lower future production costs. Because of their technological leadership in

manufacturing and their aggressive, price cutting strategies, Asians

semiconductor manufacturers such as NEC and Samsung dominate the production of

low-cost, standardized semiconductor chips. Similarly, innovative U.S

semiconductor firms such as Intel and Advanced Micro Devices utilize the

experience curve to maintain leadership in the production of high-priced,

proprietary chips that form the brains of newer microcomputers.

Harvard

Business School professor Miachael Porter’s theory of national competitive

advantage is the newest addition to international trade theory. Porter believes

that success in international trade comes from the interaction of four country-

and firm-specific elements: factor conditions: demand conditions : related and

supporting industries: and firm strategy, structure and rivalry. Porter

represents these elements as the four

corners of diamond as shown in Figure 6.5.

FIGURE

6.5

Porter’s Diamond of National Competitive Advantage

FACTOR

CONDITIONS. A country’s endowment of factors of production affects its ability

to compete internationally. Although factor endowments were the centerpiece of

the Hecksher-Ohlin theory, Porter goes beyond the basic factors-land, labor

capital- considered by the classical trade theorists to include more advance

factors such as the educational level of

the workforce and the quality of the country’s infrastructure. His work

stresses the role of factor creation through training, research, and

innovation.

DEMAND

CONDITIONS. The existence of a large, sophisticated domestic consumer base

often stimulates the development and distribution of innovating products as

firms struggle for dominance in their domestic markets. In meeting their domestic customer

needs, however, firms continually develop and fine-tune products that

also can be marketed internationally. Thus pioneering firms can stay ahead of

their international competitors as well. For example, Japanese consumer

electronic producers maintain a competitive edge internationally because of the

willingness of Japan large, well off middle class to buy the latest electronic

creations of Sony, Toshiba, and Matsushita. After being fine-tuned in the

domestic markets, new models of Japanese digital cameras, big screen TV’s and

DVD players are sold to eager European and North American consumers. A similar

phenomenon is occurring in the consumer and companies has created a fertile

climate for companies such as Ebay and Amazon.com to develop and tailor new

products to meet the needs of this market domestically and internationally.

RELATED

AND SUPPORTING INDUSTRIES. The emergence of an industry often stimulates the

development of local suppliers eager to meet that industry’s production,

marketing and distrubition needs. An industry located close its suppliers will

enjoy better communication and the exchange of cost-saving ideas and inventions

with those suppliers. Competition among these input suppliers leads to lower

prices, higher quality products and technological innovations in the input

market, in turn reinforcing the industry competitive advantage in world

markets. For example, Hollywood’s dominance of the world film industry is based

in part on the local availability of specialist input suppliers, such as

casting directors, stunt coordinators, costume and set designers, demolition

experts, animators, special effects firms and animal wranglers.

FIRM

STRATEGY, STRUCTURE, AND RIVALY. The domestic environment in which firms

compete shapes their ability to compete in international markets. To survive,

firms facing vigorous competition domestically must continuously strive to

reduce costs, boost product quality, raise productivity and develop innovative

products. Firm that have been tested in this way often develop the skils needed

to succeed internationally. Further, many of the investment thay have made to

succeed in the domestic market ( for example, in R&D , quality control,

brand image and employee training ) are transferable to international market at

low cost. Such firms have an edge as the expend abroad. Thus, according to

Porter’s theory, the international success of Japanase automakers and consumer

electronics manufactures and of Hollywood film studios is aided by intense

domestic competition in these firm;s home countries.

Porter

holds that national policies may also affects firms international strategies

and opportunities in more subtle ways. Consider the German automobile market.

German labor costs are very high. , so German automaker finds it difficult to

compete internationally on the basis of price. As most auto enthusiasts know,

however there are no speed limits on many stretches of Germany’s famed

autobahns. So German automaker such as Daimler- Benz, Porsche and BMW have

chosen to compete on the basis of the quality and the high performance by

engineering chassis, engine, brakes and suspension that can withstand the

stresses of high speed driving. Consequently, these firms dominate the world

market for high performance automobiles “ E-World “ provides another

illustration of this phenomenon. Nokia’s rise to global prominence resulting

from the geography of its home country, Finland.

Porter’s

theory is a hybrid. It blends the traditional country-based theories that

emphasize factor endowments with the firm-based theories that focus on the

actions of individual firms. Countries ( or their governments) play a critical

role in creating an environment that can aid or harm the ability of firms to

complete internationally, but firms are the actors that actually participate in

international trade. Some firms succeed internationally: others do not.

Porsche, Daimler Benz and BMW successfully grasped the opportunity presented by

Germany’s decision to allow unlimited speeds on its highway and captured the

high performance niche of the worldwide automobile industry, Conversely,

Volkswagen and Opel chose to focus on the broader middle segment of the German

automobile market, ultimately limiting their international options.

In

summary, no single theory of international trade explains all trade flows among

countries. The classical country-based theories are useful in explaining

interindustry trade of homogeneous, undiffirential products such as

agricultural goods, raw materials and processed goods like steel and aluminium.

The firm based theories are more helpful in understanding intraindustry trade

of hetereogeneous, differentiated goods, such as Sony televisions and

Caterpillar bulldozers, many of which are sold on the basis of their brand

names and reputations. Further, in many ways, Porter’s theory synthesizes the

features of the existing country based and the firm based theories. Figure 6.6

summarize the major theories of international trade.

Country- based Theories

Country is

unit of analysis.

Emerged prior

to World War II

Develop by

economists

Explain

interindustry trade

Include :

Mercantilism

Absolute advantage

Comparative advantage

Relative factor endowments

( Heckscher- Ohlin )

|

Firm – based Theories

Firm

is unit of analysis.

Emerged after

World War II

Develop

by business school professors

Explain

intraindustry trade

Include

:

Country similiraty theory

Products life cycle

Global strategic rivalry

National Competitive advantage

|

An Overview

of international investment

Trade is the most obvious but not the only form of

international business. Another major form is international investment, whereby

resident of one country supply capital to a secondary country.

Subscribe to:

Comments (Atom)